[Education] Why Would Someone Buy NEAR?

Exploring some perspectives on why someone would want to buy NEAR, in response to a post raising this questioning.

On Dec. 17, tmek made a post saying “NEAR is cool,” but questioning the token’s utility. “Im not buying it,” he concluded. This is a totally fair decision to make and I respect his stance.

Buying or not buying NEAR 0.00%↑ is an individual choice.

It’s also a matter of perspective and it’s totally fair to decide not to buy it.

Yet, I’ll explore some perspectives on why to buy NEAR.

→ UTILITY

→ INVESTMENT

NEAR’s UTILITY

tmek mentioned he “[doesn’t] even know what the token is for.”

So I’ll start with NEAR’s utility first.

→ UTILITY

> paying for gas fees

> staking to support the network

> use as a currency or collateral

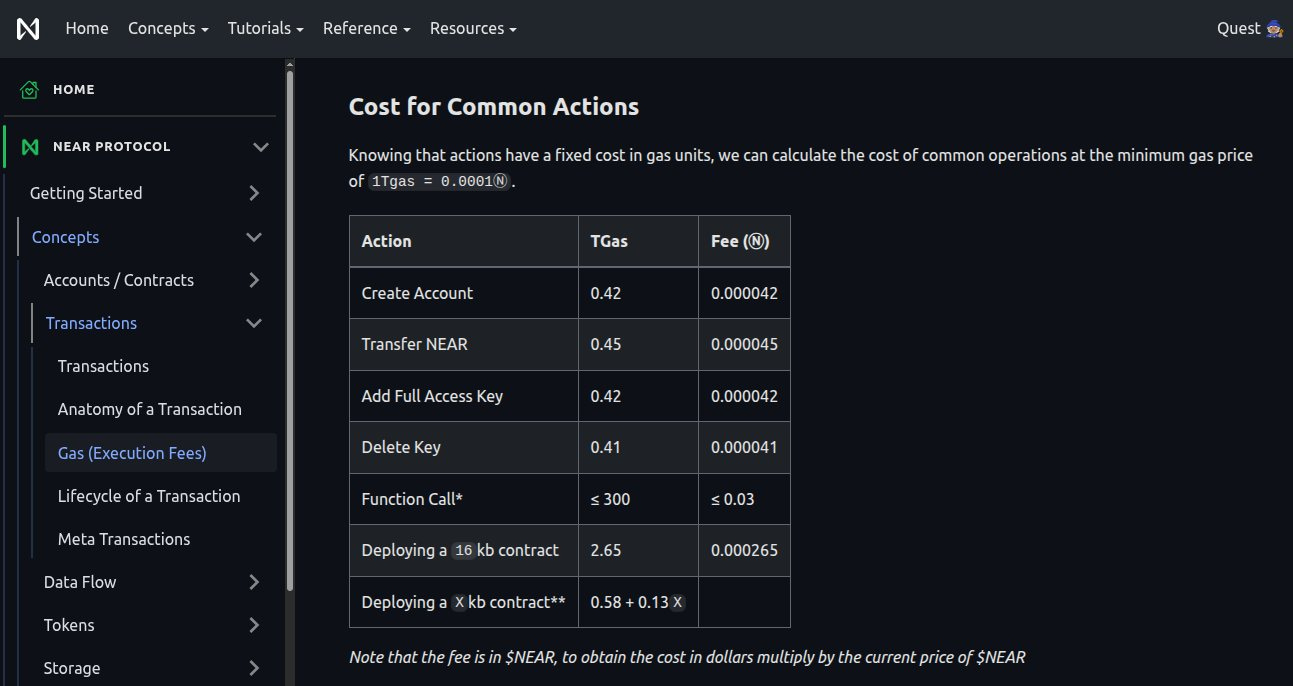

Paying for gas fees

Everyone interacting with the NEAR blockchain needs NEAR to pay for the gas fees, as every single transaction and/or smart contract execution consumes gas, which requires fees.

However, this will, sometimes, be abstracted to the end user (like tmek) while interacting with, for example, NEAR Intents via specific frontends.

The thing is... there is no free meal.

-> someone is paying for the gas you are consuming

--> even if indirectly

-> and it’s done with NEAR

Gas can cost as low as Ⓝ0.000042 to create an account, Ⓝ0.000045 to transfer the native token NEAR, and up to Ⓝ0.03 for a complex smart contract function call.

Staking to support the network

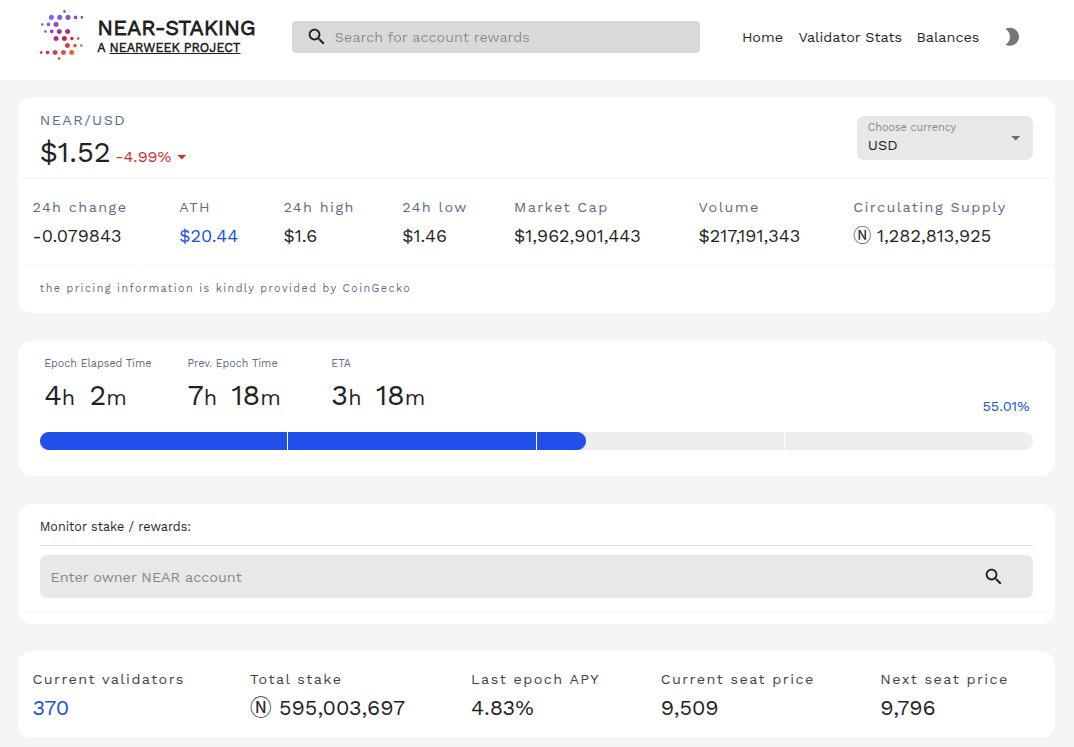

NEAR is a proof-of-stake blockchain, meaning that its security and liveness depend on people staking NEAR (by locking it in a validator smart contract).

Anyone who sees value in the network can either run a validator or delegate NEAR to validators of their choice, directly supporting the network they get value from (for example, using it via NEAR Intents, like tmek).

The more NEAR staked, the higher the cost to attack it.

The more distributed NEAR’s staking is among different validators in different geolocations, the more decentralized the network is.

The more NEAR staked to good validators, the more resilient and better performing the network can be.

So, it makes sense to buy and stake NEAR if you think the whole infra is worth enough protecting and improving so you can make sure it will always be there in a good state for you to use it.

*I run a validator that takes delegation at thecoding.pool.near

Use as a currency or collateral

NEAR (Ⓝ) is a currency:

→ Ⓝ is a medium of exchange

→ Ⓝ is a unit of accounting

→ Ⓝ is a store of value

Kalshi recently added support for NEAR (the token).

NEAR also has a growing DeFi ecosystem and can be used as collateral for loans on Rhea Finance -- either directly or via its liquid staking derivatives.

NEAR has 3 liquid staking protocols and tokens:

→ stNEAR (by Meta Pool)

→ LiNEAR (by LiNEAR Protocol)

→ rNEAR (by Rhea Finance)

These tokens benefit from NEAR’s staking APY (~4%) while still being able to be used as collateral or as a currency, like Ⓝ.

NEAR AS AN INVESTMENT

→ INVESTMENT

> price speculation

> yield farming + hedging the token’s inflation

> long term store of value

Price speculation

So, NEAR is useful (and valuable) to many people and projects in a growing ecosystem. Nevertheless, it’s perfectly fine that someone may not want to use it for these things...

These people can still (if they want to) buy NEAR exclusively as an investment vehicle while speculating that enough other people will use the token for what I described above (or for other things).

If enough people do it and the buying pressure (demand) overcomes the selling pressure (supply), the NEAR price increases.

“It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self-fulfilling prophecy”

- Satoshi Nakamoto on Bitcoin in the early days

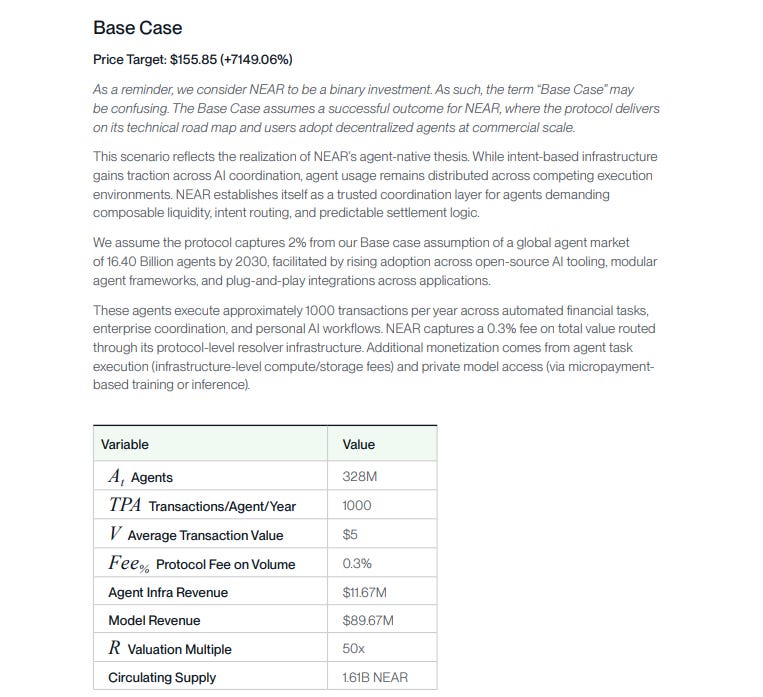

Bitwise recently posted a complete research piece exploring its thesis around NEAR’s price speculation, with calculations based on its use rate increasing.

Bitwise’s NEAR price targets for 2030:

→ Bear Case at $1.63/Ⓝ

→ Base Case at $155.85/Ⓝ

→ Max Case at $562.81/Ⓝ

Yield farming + Hedging the token’s inflation

NEAR currently has an annual inflation of 2.5% via a tail emission mechanism with this fixed rate against the circulating supply.

It was 5% before Oct. 28, when more than 80% of validators (by stake) approved its halving.

Yet, with only ~50% of all circulating NEAR staked, the staking APY hovers around 4.5% for direct staking and will vary for delegators according to the pool fees their validators have set.

If NEAR keeps a stable price

-> it’s roughly a 4.5% yield farming opportunity (passive income)

If NEAR price increases, as we explored in posts (7) and (8), this yield compounds.

However, there is also the possibility that NEAR’s demand stagnates and it could temporarily suffer from the token’s inflation, with its price dropping accordingly.

In that sense, NEAR holders can hedge this inflation by staking NEAR, directly participating in (and benefiting from) the tail emission -- as only non-stakers being negatively affected.

Long-term store of value

All things considered, NEAR has strong fundamentals to become a solid long-term store of value if things play out positively and NEAR has a consistently growing demand

-> either for utility or investment perspectives.

This increases the purchasing power of NEAR holders,

This improves the network’s security and liveness,

and enriches the ecosystem, benefiting the builders.

NEAR also has strong tokenomics that favor a reducing supply.

→ 100% of all gas fees paid to Ⓝ txs are burned,

→ 70% of all gas fees paid to smart contract executions are burned (while 30% are given to the smart contract owner).

It’s a strong burning mechanism at the protocol level.

In conclusion, it all relies on the infrastructure actually being used -- No matter if you are using it yourself or speculating whether others will.

Hope this thread could’ve shed some light on my perspective.

What is your perspective on NEAR now?